Kings County Ny Property Appraiser

Kings County, NY Property Tax Calculator 2025-2026

Calculate Your Kings County Property Taxes Kings County Tax Information How are Property Taxes Calculated in Kings County? Property taxes in Kings County, New York are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.68% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/newyork/kings-county

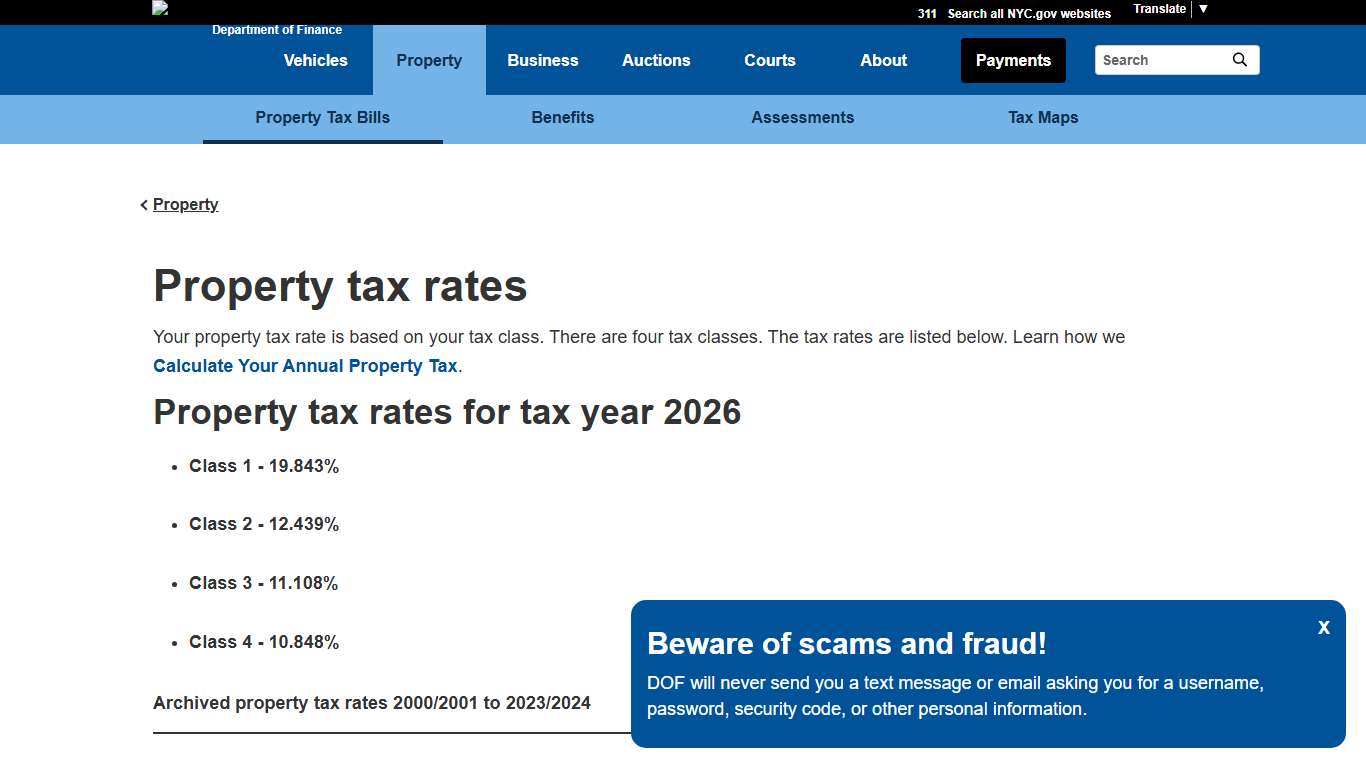

Property Tax Rates

PropertyProperty tax rates Your property tax rate is based on your tax class. There are four tax classes. The tax rates are listed below. Learn how we Calculate Your Annual Property Tax. Property tax rates for tax year 2026 - Class 1 - 19.843% - Class 2 - 12.439% - Class 3 - 11.108% - Class 4 - 10.848% School tax rates for tax years 1981-2018 Historically, school tax rates...

https://www.nyc.gov/site/finance/property/property-tax-rates.page

Property tax forms - Exemptions

Application for Conservation Easement Agreement Exemption: Certain Towns (Guilderland and Danby)...

https://www.tax.ny.gov/forms/orpts/exemption.htm

Fee Schedule

2026 Clerk/Recorder Fees. Free viewers are required for some of the attached documents. They can be downloaded by clicking on the icons below.

https://www.countyofkingsca.gov/departments/general-services/assessor-clerk-recorder/fee-scheduleProperty Taxes

Beginning January 1st, 2026: All debit and credit card payments are subject to a 2.35% service fee, with a minimum fee of $2.00. The service fee is charged by our payment processor. King County does not receive any part of the service fee.

https://payment.kingcounty.gov/Home/Index?app=PropertyTaxes

King County Appraisal District

The King County Appraisal District appraises property for ad valorem taxation of these taxing authorities. King County Guthrie Common School District Crowell ISD Gateway GCD The duties of the appraisal district include: - The determination of market value of taxable property - The administration of exemptions and special valuations authorized by the local entities and the State of Texas Tax rates and ultimately the amount of taxes levied on pr...

https://www.kingcad.org/

Looking Back at 2025 to Prepare for the 2026 Tax Season in New York - The Palm Beach Post

O’Connor discusses how looking back at 2025 to prepare for the 2026 tax season in New York. NEW YORK, NY, UNITED STATES, January 16, 2026 /EINPresswire.com/ — While the holiday season has come to an end, the property tax season in New York is just beginning.

https://www.palmbeachpost.com/press-release/story/136413/looking-back-at-2025-to-prepare-for-the-2026-tax-season-in-new-york/

Town of Brooklyn - Tax Bills Search & Pay

Click on Sewer/Water/Misc ABOVE if you want to search Sewer/Water/Misc bills. Click on Tax Bills if you want to search your Real Estate, Personal Property, Motor Vehicle or Supplemental Bills. Please abbreviate: Street to St, Road to Rd, Etc.

https://www.mytaxbill.org/inet/bill/home.do?town=brooklyn

Looking Back at 2025 to Prepare for the 2026 Tax Season in New York - The Palm Beach Post

O’Connor discusses how looking back at 2025 to prepare for the 2026 tax season in New York. NEW YORK, NY, UNITED STATES, January 16, 2026 /EINPresswire.com/ — While the holiday season has come to an end, the property tax season in New York is just beginning.

https://www.palmbeachpost.com/press-release/story/136413/looking-back-at-2025-to-prepare-for-the-2026-tax-season-in-new-york/

Per diem rates GSA

Per diem rates We establish the per diem rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while on official travel within the continental United States. A standard rate applies to most of CONUS.

https://www.gsa.gov/travel/plan-a-trip/per-diem-rates

Kings County, NY Property Records Owners, Deeds, Permits

Instant Access to Kings County, NY Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Kings County, New York, comprises the City of Brooklyn and six rural towns.

https://newyork.propertychecker.com/kings-county

Fair Market Rents (40th PERCENTILE RENTS) HUD USER

HUD’s Office of Policy Development and Research (PD&R) is pleased to announce that Fair Market Rents and Income Limits data are now available via an application programming interface (API). With this API, developers can easily access and customize Fair Market Rents and Income Limits data for use in existing applications or to create new applications.

https://www.huduser.gov/portal/datasets/fmr.html

County Treasurer - Essex County, New York

The Essex County Treasurer’s Office now accepts credit and debit card payments. Essex County Treasurer Michael Diskin Treasurer’s Office: (518) 873-3310 Fax: (518) 873-3318 Address: 7551 Court Street, P.O. Box 217, Elizabethtown, New York 12932 Hours of Operation (September – April): Monday – Friday 9:00 AM – 5:00 PM Summer Hours (May – August): Monday – Friday 8:00 AM – 4:00 PM *Closed for legal holidays and the day after...

https://essexcountyny.gov/county-treasurer/

Search Tax Records

Search By Property Location Property Location Image. Required fields are indicated with an asterisk (*) Property - Tax Year*. 2026, 2025, 2024, 2023, 2022 ...

https://mcweb1.co.morris.nj.us/MCTaxBoard/SearchTaxRecords.aspx

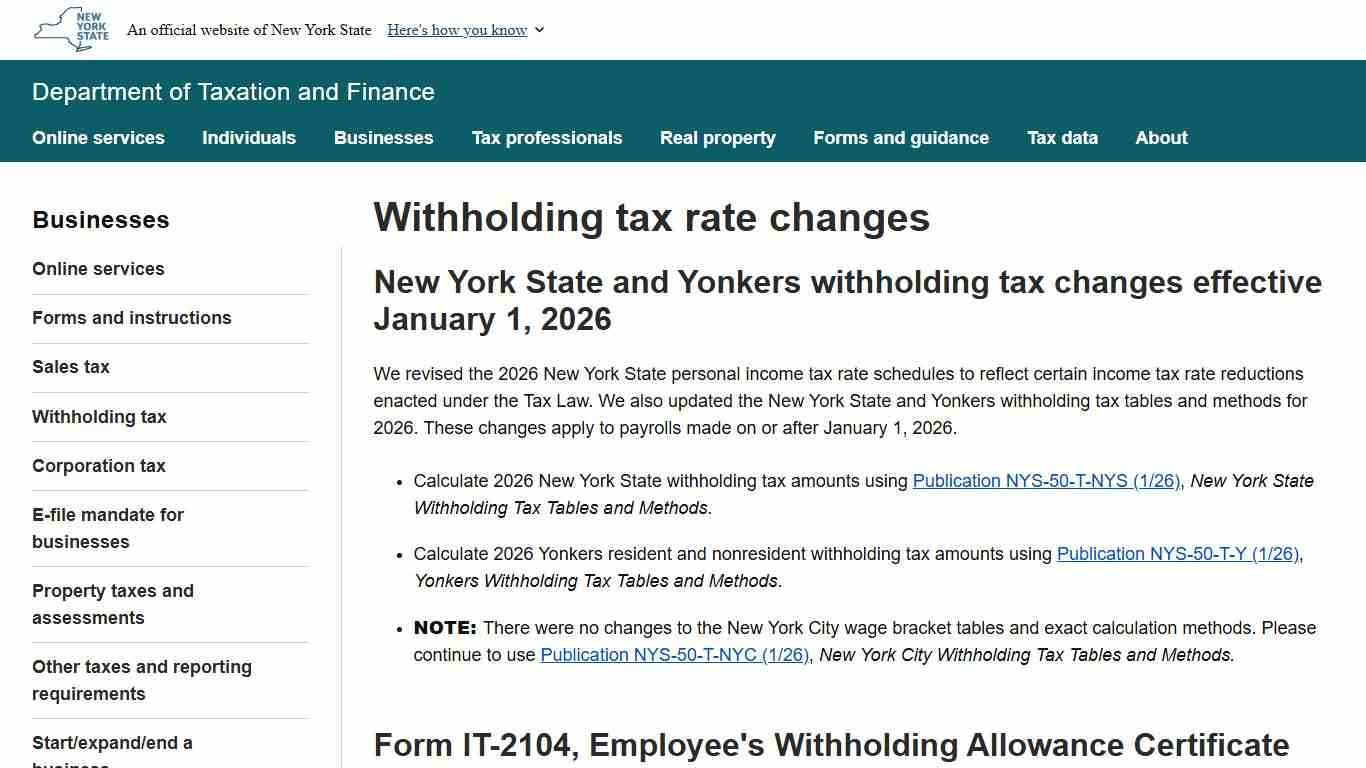

Withholding tax rate changes

Withholding tax rate changes New York State and Yonkers withholding tax changes effective January 1, 2026 We revised the 2026 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. We also updated the New York State and Yonkers withholding tax tables and methods for 2026.

https://www.tax.ny.gov/bus/wt/rate.htm

View/Pay Your Property Taxes Smithtown, NY - Official Website

View/Pay Your Property Taxes The Office of the Receiver of Taxes welcomes you to the Town of Smithtown’s On-line Tax Lookup and Payment System. To facilitate payment please have your current tax bill in hand since you will be required to supply that information when payment is made.

https://www.smithtownny.gov/180/ViewPay-Your-Property-Taxes